The Importance of Assessing Risks in Investment Projects

Introduction

Investment projects are an integral part of the business world, allowing companies to expand, innovate, and generate profits. However, with great opportunities come great risks. Understanding and assessing these risks are crucial for the success and sustainability of any investment project.

Main Content

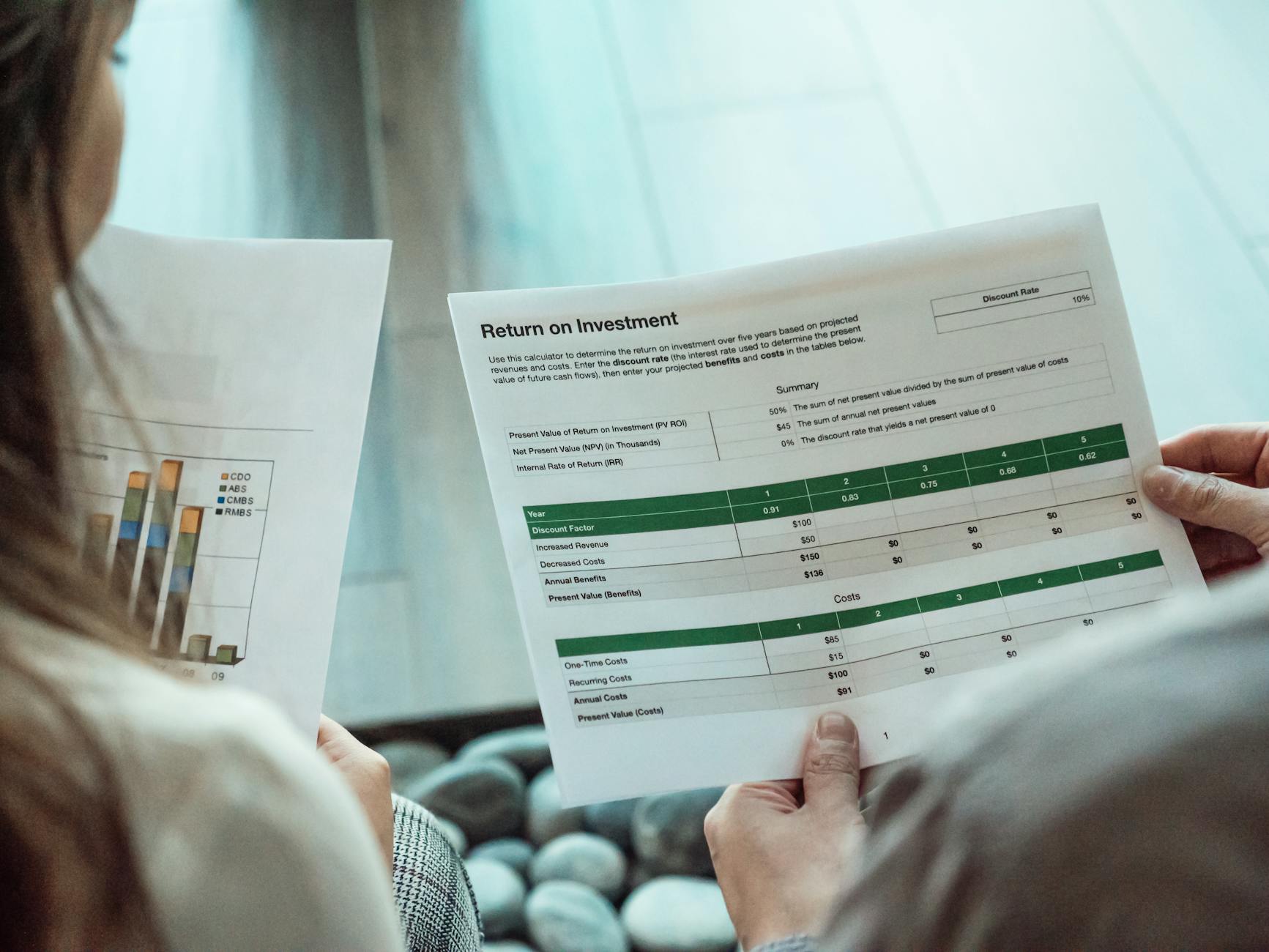

One of the key risks associated with investment projects is financial risk. This includes potential losses due to market fluctuations, economic downturns, or unexpected expenses. By conducting a thorough financial analysis, investors can identify potential risks and develop strategies to mitigate them.

Operational risks are another critical aspect to consider. These risks involve factors such as project management issues, technological challenges, or regulatory changes that can impact the project's timeline and success. By assessing operational risks early on, project managers can implement measures to ensure smooth project execution.

Market risks are also significant, especially in industries with high competition or volatile market conditions. Factors such as changing consumer preferences, new technologies, or geopolitical events can influence the project's profitability. Evaluating market risks allows investors to adapt their strategies and stay ahead of the curve.

Furthermore, environmental and social risks are gaining more attention in the investment landscape. Climate change, social unrest, and ethical concerns can all affect the long-term viability of a project. By conducting thorough environmental and social impact assessments, companies can demonstrate their commitment to sustainability and responsible investing.

Conclusion

In conclusion, the risks associated with investment projects are diverse and complex. However, by proactively assessing these risks and developing mitigation strategies, companies can enhance their chances of success and long-term growth. Investing in risk assessment tools, conducting thorough due diligence, and staying informed about market trends are essential practices for any investor looking to navigate the challenging landscape of investment projects.